Table of Contents

Signs of strengthening demand as market conditions stabilize

The global economy was resilient in the final quarter of 2023, but conditions remain challenging. Monetary conditions are still tighter than a year ago, labor markets have softened and price levels are elevated, while there are risks from conflicts and policy uncertainty. We expect continued volatility in 2024, although post-pandemic disruptions are moderating with signs of strengthening occupier demand and renewed momentum in capital markets. Economic growth is set to be below trend and historic rates in 2024, but as inflation eases further and policy rates are cut, the second half of the year looks stronger and momentum should build from there into 2025.

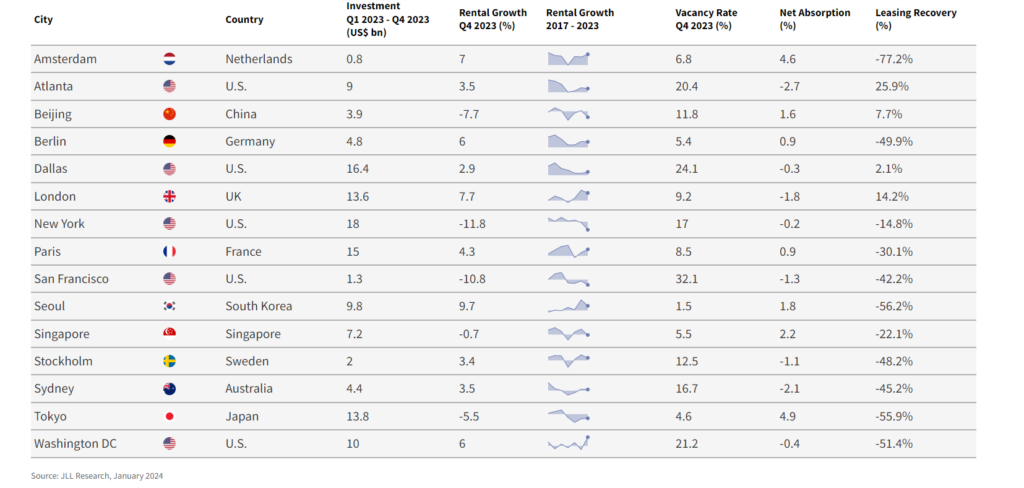

Following another year of transition for many office occupiers, the final quarter of 2023 saw an improvement in activity as global office leasing volumes increased by 13% from the previous quarter. This was still 19% below the pre-pandemic average, but marked the strongest quarter since Q2 2022. There were also positive signals in global logistics markets as leasing volumes in the U.S. rose by 17% following six consecutive quarters of declines, while net absorption in Asia Pacific set a new annual record. Rising real wages and travel to urban destinations have supported selective strengthening in retail and hospitality performance.

Signs of strengthening demand as market conditions stabilize

Easing interest rates expected to shape pathway to gradual recovery

As the markets enter 2024 conditions continue to vary, but momentum is expected to build as the year progresses. Debt markets remain liquid, but the cost of debt is still impacting dynamics across most markets globally. Loan workouts and refinancings will continue to be in focus in the elevated rate environment, and lenders are maintaining a sector-focused approach, with sentiment most strong for logistics, living and select alternative growth sectors. Market consensus indicates that rates have now reached peak levels, and downward movements in rates are already being priced into the markets for 2024.

Price discovery has continued across markets globally, with noticeable yield adjustments observed throughout last year. The asset class has witnessed a growing number of bidders re-entering the market since late 2022, supporting the steady improvement in global bid intensity. The U.S. is furthest along in its price adjustment cycle, followed by Europe and then Asia Pacific.

As the markets improve, sector diversification will remain in focus to bring critical benefits and mitigate risks across sectors and within them. While out of favor sectors such as offices have faced elevated pressure and scrutiny, the real estate asset class is currently undergoing a dynamic shift in investment strategies, favoring growth sectors across industrial, living, and select alternative sectors. Diversification will take different forms in markets around the world, and even those less-favored sectors still have a place in global, diversified portfolios. In the near term, investors are likely to adopt a cautious approach to navigate uncertainty, and deployment will be a hurdle given varied degrees of barriers to entry, competition and crowding-in strategies in those growth-oriented sectors.

While the pathway to market recovery is anticipated to be uneven and gradual across markets and sectors, the return of predictability will be crucial in stabilizing valuations and unleashing liquidity, paving the way for a more balanced market environment.