Table of Contents

State of the Market

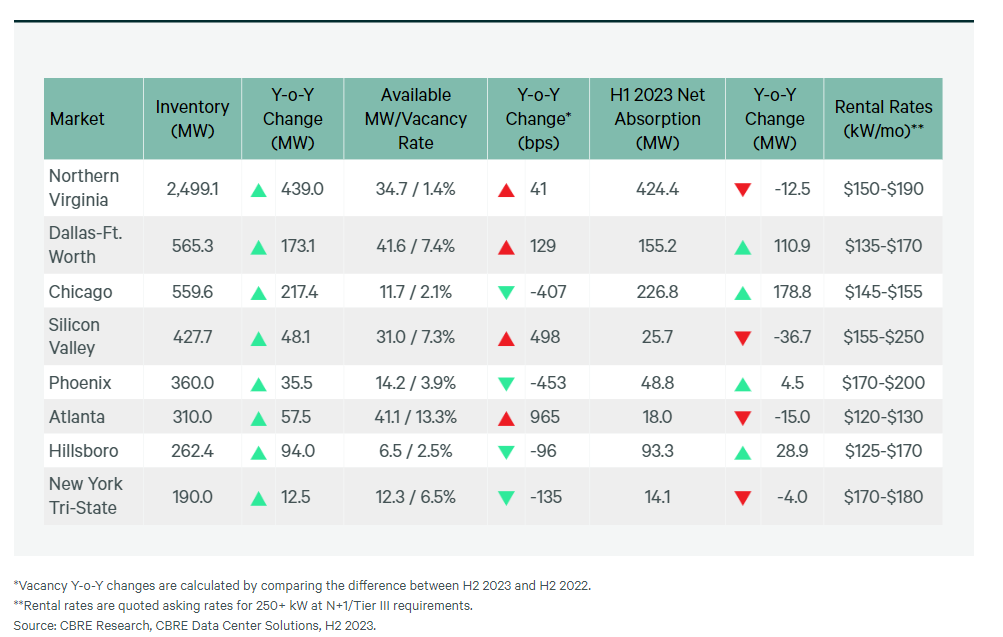

- In 2023, primary market supply grew 26% year-over-year to 5,174.1 MW.

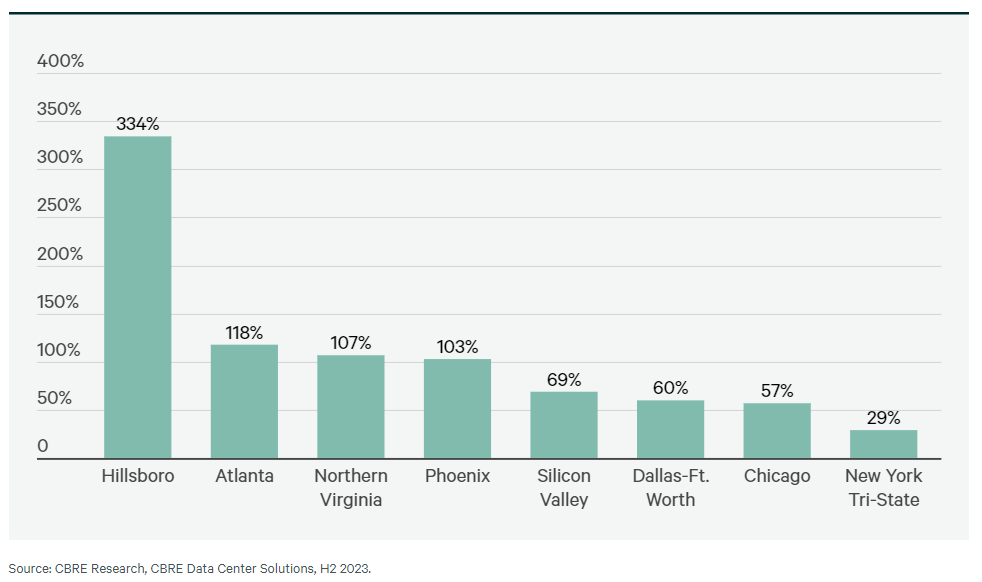

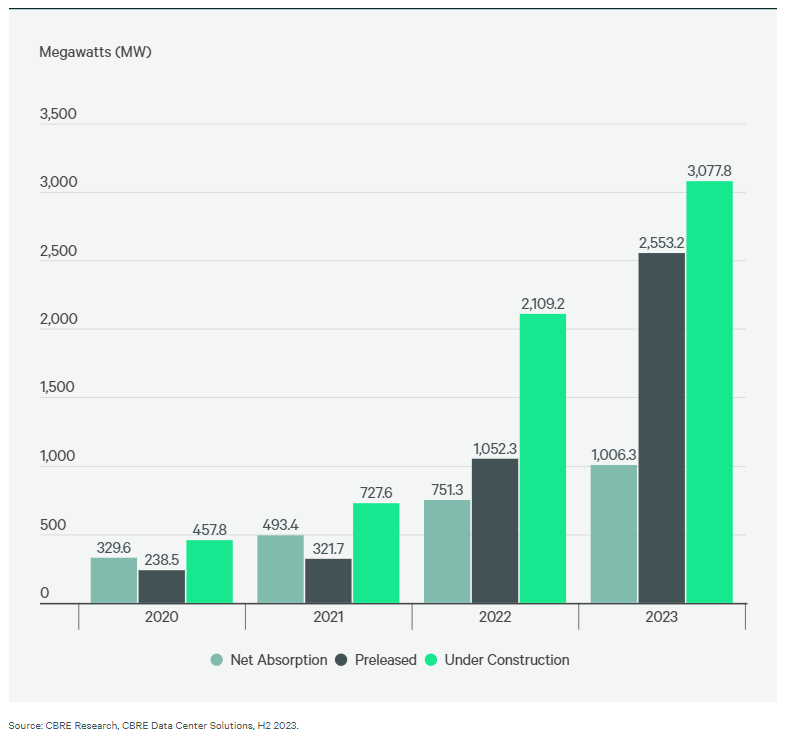

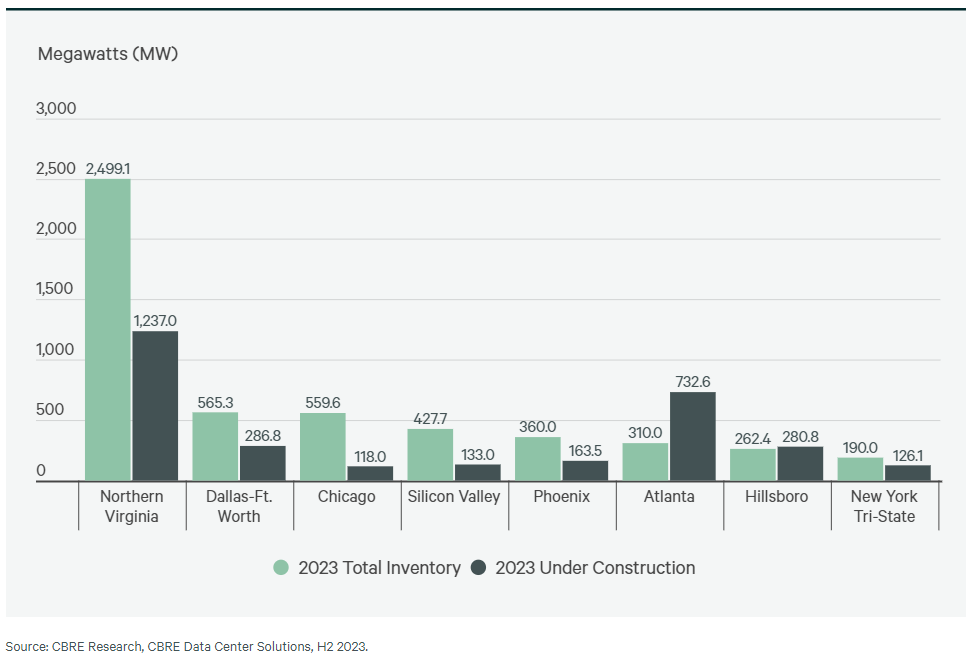

- An all-time high of 3,077.8 MW was under construction in primary markets, a 46% year-over-year increase. Construction increased most in Atlanta, growing by 211% to 732.6 MW under construction.

- The average monthly asking rate for a 250- to 500-kW requirement across primary markets increased by 18.6% year-over-year, to $163.44 per kW/month. Northern Virginia had a 42% year-over-year price increase, the largest among primary markets.

- Preleasing activity in primary markets is strengthening, with 2,553.1 MW (83%) of the 3,077.8 MW under construction preleased. Cloud providers continue to lease most available power capacity, but artificial intelligence (AI) is also driving significant demand.

- The overall vacancy rate for primary markets remains near a record low, at 3.7%. With few relocation options, most tenants are renewing existing leases rather than seeking new facilities.

- Power availability continued to influence data center operators’ location decisions more than geography did.

H2 2023 Wholesale Primary Market Fundamentals

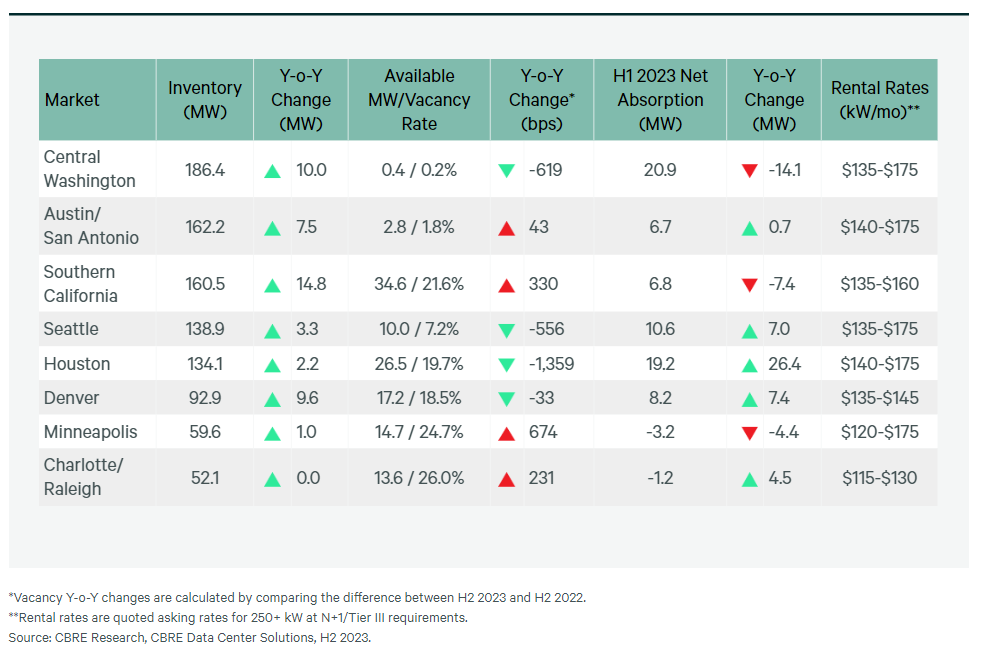

H2 2023 Wholesale Secondary Market Fundamentals

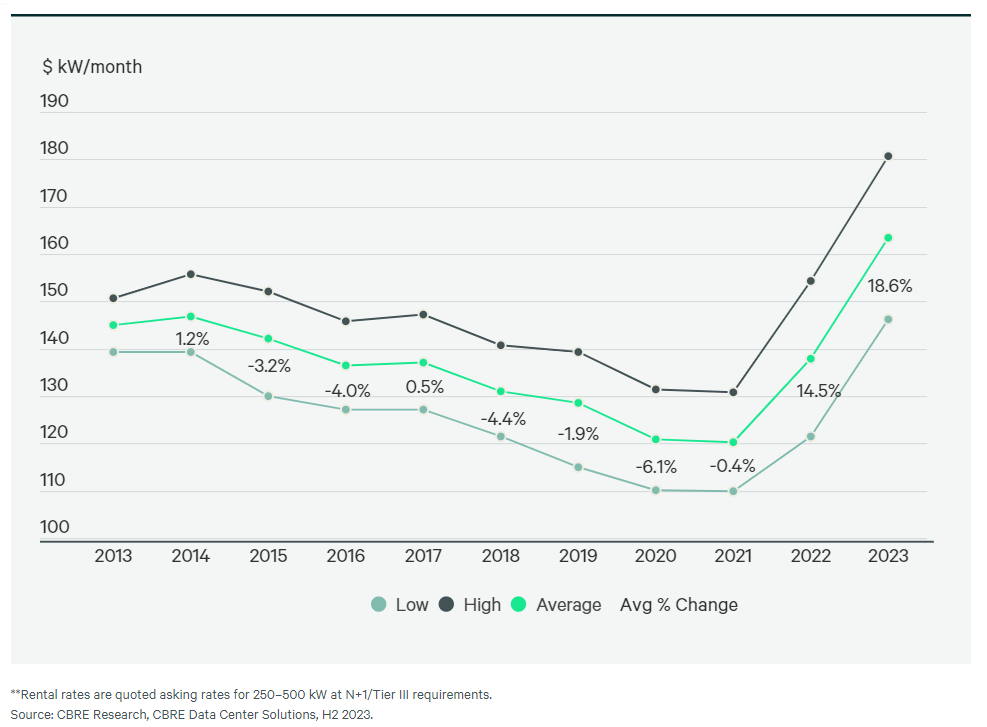

National Lease Pricing

- Limited supply and strong demand drove up asking rates in H2 2023. The average asking rate across primary wholesale colocation markets for a 250- to 500-kW requirement increased by 18.6% year-over-year to a record $163.44 per kW/month.

- Occupiers in California and Virginia faced higher operating costs due to rising fuel costs and taxes as well as electricity rate increases in certain local jurisdictions.

- Data center operators are increasingly investing in renewable energy sources and electricity efficiency practices with cooling technologies. While potentially offering long-term savings, this may require significant upfront investment that can cause pricing to increase.

- Generally, there is a material pricing difference between a new-build facility and a legacy data center.

- Construction costs remain elevated due to ongoing shortages in critical materials like generators, chillers and transformers, despite improved supply chain resilience.

Average Asking Rental Rate with Y-o-Y % Change for Primary Markets

Capital Markets Insights

- New capital sources are attracted by record tenant demand, historic low supply, strong rental growth and data center investment performance. There are ample debt financing options across real estate lenders, infrastructure funds, project finance, TMT lenders, life insurance companies and others.

- Total transaction volume of all data center asset sales increased year-over-year, despite a decline in the number of sales transactions.

- Many would-be sellers remained on the sidelines in 2023 in response to global macroeconomic headwinds, lending volatility and cap rate expansion due to interest rates. Overall activity was largely driven by a handful of transactions from REITs seeking to fund their development pipelines.

- Growing investor interest across the risk spectrum, robust development pipelines and a more stable lending environment should drive more capital markets activity in 2024.

- In this higher-interest rate environment, debt yield and debt-service coverage ratio have become the preferred metrics, as opposed to loan-to-value. As a result, overall leverage levels have decreased to meet cash flow metric stipulations.

Notable H2 2023 Investment Activity

- Transactions announced by Digital Realty drove significant investment activity:

- $7 billion joint venture initiated with Blackstone to develop hyperscale data centers in Frankfurt, Paris and Northern Virginia

- $1.3 billion sale of its 80% interest in three Northern Virginia data centers to TPG Real Estate

- $743 million sale of its 65% interest in two stabilized data centers in Chicago to GI Partners

- $275 million sale of its remaining interest in four Cyxtera data centers to Brookfield

- $200 million sale of its 80% interest in a build-to-suit data center in Northern Virginia to Realty Income

- KDDI closed its $1 billion acquisition of Allied Properties’ data center portfolio.

- Manulife Investment Management completed its acquisition of Serverfarm.

Inventory Growth of Primary Data Center Markets since 2020

Valuation Insights

Transactional data remained limited in H2 2023. However, activity increased in Q4, which included asset sales from Cyxtera’s bankruptcy and new investments from Brookfield. Although capital costs remain high, market-level supply-and-demand dynamics continue to support strong rent growth. Landlords are eager to end leases in power-constrained markets to re-lease at higher prices. Increased market rent dynamics have the potential to push down cap rates and create opportunity for non-stabilized assets with contracts below the current market rate. Some operators are also exploring underserved markets.

Lending activity persists for projects under construction, especially preleased and stabilized assets where developers and operators have committed to completion schedules to meet promised lease commencement dates. Data center providers and customers continue acquiring land in both primary and secondary markets, with lack of suitable sites causing bidding wars for offerings that meet desired power and fiber requirements.

The largest hyperscalers’ new developments will complete construction and become operational in established, secondary and tertiary markets over the next few years—with AI requirements driving further demand. This demand increased through H2, leading to significant debt financing by firms such as Blackstone/QTS, Compass and PGIM to fund new development. Additionally, Vantage Data Centers announced a significant equity infusion to support its growth. Digital Bridge’s Marc Ganzi recently projected AI could eventually more than double the cloud services market’s power requirements.

Power remains undersupplied and is being exacerbated by a scarcity of as-of-right zoned developable land, which offers a faster and more efficient entitlement process. An outcome of Loudoun County, Virginia’s December 2023 zoning ordinance is that sites for data center development on office and research and development park-zoned land must undergo a special exemption review. This could increase the value of greenfield sites for projects breaking ground sooner and/or grandfathered under prior development guidelines, further supporting rising lease rates and/or pushing development into less established markets.

Primary Markets Historic Net Absorption, Preleasing & Under Construction

Network Insights

- Notable Network Activity

- More middle-mile fiber infrastructure is being built across the U.S., including Lake Michigan’s first carrier-neutral underwater cable project, announced in H2 2023. A component of the $87.5 million project is two new cables under Lake Michigan connecting Grand Rapids, MI to Lakeside Technology Center at 350 E Cermak Rd. in Chicago. This will strengthen Michigan’s data center market, offering a new long-haul path and lower latency.

- Last year, major content providers constructed and/or financed more custom fiber networks to interconnect hyperscale facilities. These private networks provide alternative, low-latency, high-capacity pathways between their facilities. Development is continuing in primary markets such as Atlanta, Dallas-Ft. Worth and Northern Virginia, as well as in tertiary markets such as New Albany, OH, Huntsville, AL, Nashville, TN and Altoona, PA.

- Electric companies such as Dominion, Georgia Power and ComEd have begun deploying and maintaining fiber networks in primary and secondary markets—bolstering network resiliency by establishing unique and secure data pathways. Hundreds of local electric utilities providers have also initiated this in tertiary markets.

- Fiber infrastructure development has strongly increased in the greater Chicago metro due to new hyperscale data centers’ demands and other consistently rising data demand. Crosstown Fiber is currently building a high-capacity, multi-duct fiber system to connect the Elk Grove data center hub near O’Hare International Airport to the downtown core. The Illinois State Toll Highway Authority (ISTHA) is currently deploying new fiber along key Tollway fiberoptic network routes where demand surpassed existing capacity. Large companies such as AT&T, Verizon, Comcast, Astound Broadband, Crown Castle, Zayo and Lumen also have Chicago-based projects at varying development stages.

Total Inventory vs. Under Construction by Primary Market, H2 2023

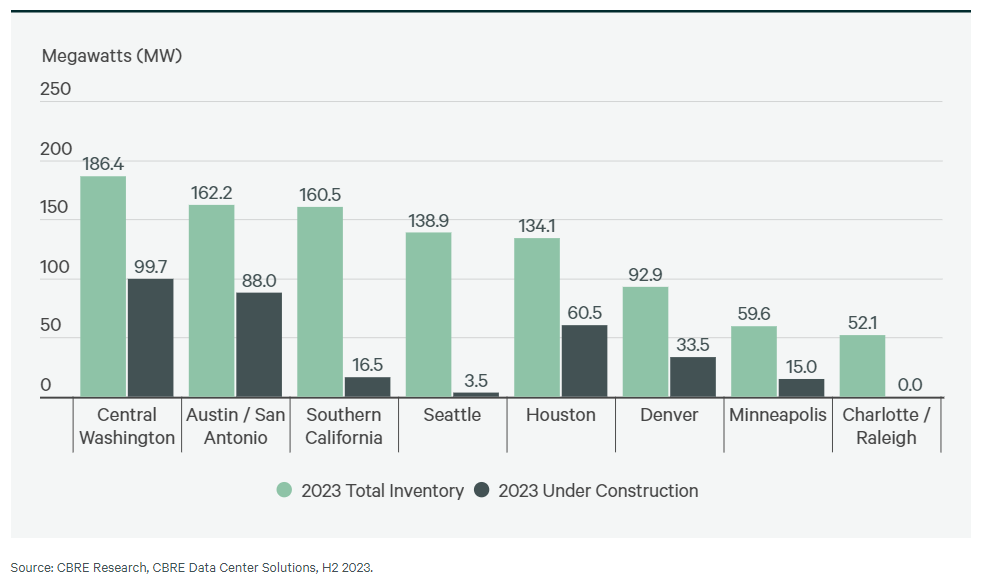

Total Inventory vs. Under Construction by Secondary Market, H2 2023

Data Center Outlook

- Data center infrastructure demand keeps increasing with the economy’s continued digitization. Revenue from generative AI software advancements is expected to increase at a 58% compound annual growth rate from 2023 to 2028, according to S&P Market Intelligence. This growth is being fueled by AI’s further development across technology, healthcare, finance and other sectors.

- Digital transformation will accelerate the need for processing power, storage and cloud services in colocation and hyperscale data centers to provide organizations with more flexibility. However, certain workloads will remain on-premises.

- Cloud service provider and AI company partnerships with other large U.S. companies may emerge to help bring new AI solutions to end users. This will lead to new edge data centers deployed on- or near-premises across various real estate asset classes, including retail, industrial, office, telecommunications towers and more.

- More operators and developers of industrial, retail, shopping center and office real estate will install low-latency fiber, DAS systems and private networks to attract both data-intensive and connectivity-focused occupiers.

- Colocation pricing is expected to increase by double-digits in 2024, as limited power availability and other constraints prevent available supply from expanding quickly.

- Despite power availability delays and rising construction costs, under-construction activity in primary markets is expected to reach a new all-time high of more than 2,500 MW in 2024.

- New markets across North America, like Wisconsin and Indiana, will host large data center campuses in 2024. This will be influenced by tax incentives, renewable power advancements, transmission and distribution electricity infrastructure and affordable power supply.

Trends to Watch

- International Data Corporation (IDC) forecasts that the global AI software market will grow from $64 billion in 2022 to nearly $251 billion in 2027, a 31.4% compound annual growth rate.

- Data centers will require more storage and compute capacity as business, commerce and personal smart device usage continues rising. There will be over 50 billion Internet of Things-connected (IoT) devices by 2025, according to McKinsey.

- More North American utility companies and municipalities will consider transmission and distribution infrastructure development to expand load growth capacity, reducing electricity grid constraints.

- Adoption of newer, lower-carbon energy solutions such as nuclear, geothermal and hydropower will continue, instead of natural gas and coal.

- Natural gas prices remained stable in 2023, after a volatile 2022. In markets highly dependent on natural gas, such as Atlanta and Dallas-Ft Worth, will we continue to see appetite for additional renewable energy projects such as wind and solar?

- Vacancy rates are projected to be near record-lows in 2024, which will prompt users to shift from lengthy request-for-proposal (RFP) processes to simplified letters-of-intent (LOI) for quicker space procurement.