Table of Contents

Key Findings

- Investors cited higher-for-longer interest rates, tight credit conditions and differing buyer and seller expectations as the biggest impediments to commercial real estate investment activity in 2024.

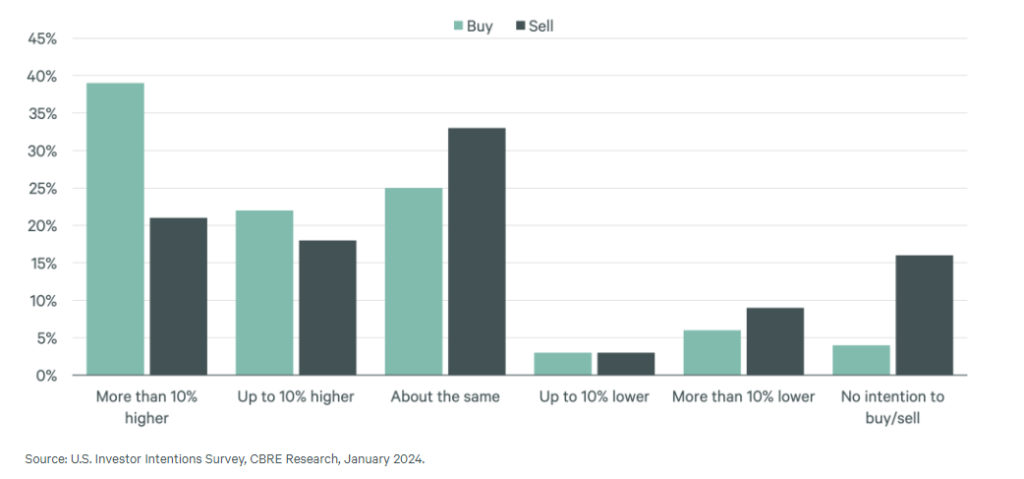

- More than half of the investors surveyed plan to buy more assets in 2024 than in 2023. Despite less favorable pricing conditions, 40% of respondents plan to sell more than last year. Private equity and real estate funds expect to be more active buyers and sellers in 2024 than other investor types.

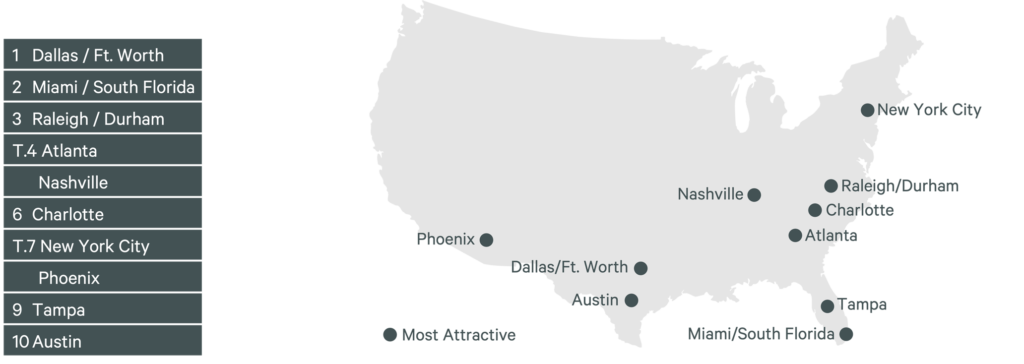

- Investors continue to favor Sun Belt cities, high-growth secondary markets and some large East Coast markets for property investment in 2024. Dallas was the most preferred market, followed by Miami, Raleigh, Atlanta and Nashville.

- More investors than last year plan to adopt opportunistic and core-plus strategies. This indicates investors are looking for higher yields and stable income.

CBRE’s 2024 U.S. Investor Intentions Survey found that higher-for-longer interest rates, tight credit conditions and differing buyer and seller expectations are the biggest concerns for real estate investors this year. Recession fears eased from last year.

Investor sentiment has significantly improved. Over 60% of respondents expect to purchase more real estate in 2024 than in 2023, compared with only 16% in 2023 versus 2022. A higher percentage of developers, private equity funds, real estate funds and REITs plan to buy more assets in 2024 than other investor types.

Despite lower property values, 40% of respondents expect to sell more assets in 2024 than 2023, compared with only 14% in last year’s survey. Private equity and real estate funds indicate that they are also likely to sell more in 2024 than other investor types.

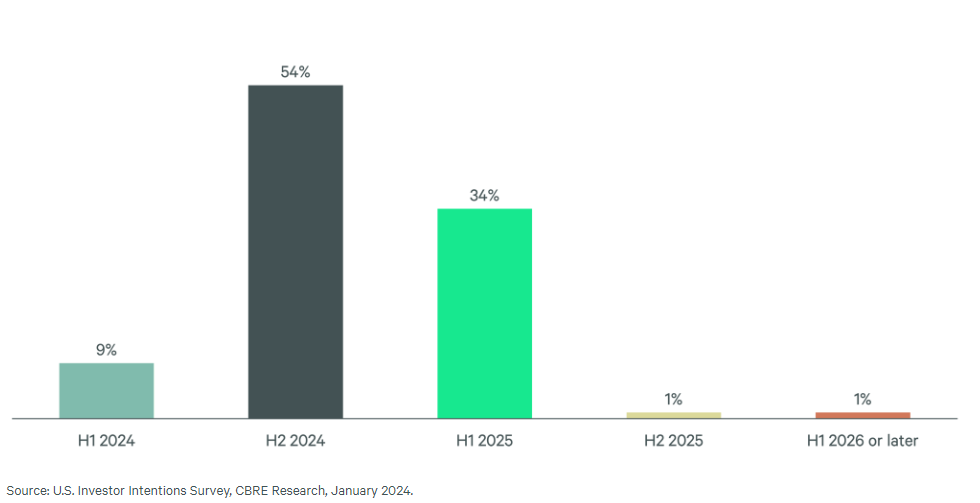

About half of investors expect that both their own transaction activity and that of the broader market will recover in the second half of 2024. However, we expect this may occur earlier if the 10-year Treasury yield declines more quickly than expected. CBRE forecasts that the 10-year yield will fall to 3.6% by year-end.

Investment activity expectations for 2024

Expectation of when investment activity will pick up

Large Sun Belt cities and high-performing secondary markets remain attractive for investors in 2024. Dallas, Miami, Raleigh and Nashville are the most preferred investment markets. Dallas took the top spot for the third consecutive year.

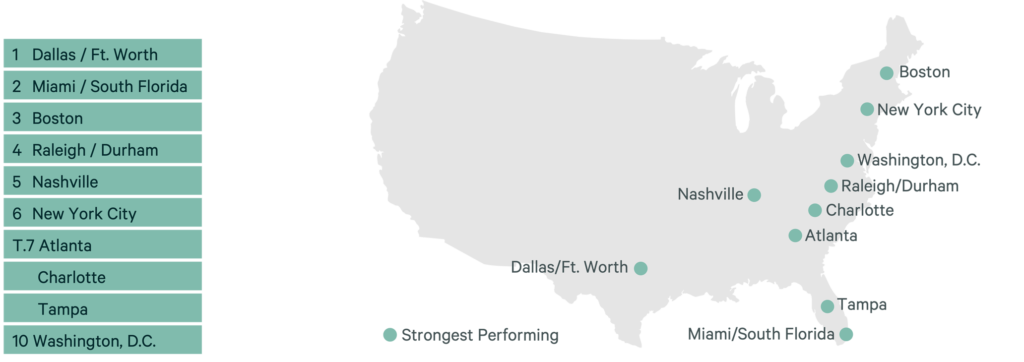

While investors continue to expect Sun Belt markets to perform well, some large gateway markets are also viewed as top performers. Boston ranked third, New York City sixth and Washington, D.C. 10th.

Top 10 markets for total property returns

Top 10 most attractive markets for investment

Multifamily and industrial & logistics remain the most sought-after property sectors in 2024. Ninety percent of multifamily investors prefer Class A properties, while nearly half favor value-add Class B/C assets. Class A facilities in major markets are most preferred by industrial & logistics investors. Grocery-anchored centers are most favored by retail investors, while nearly 60% of office investors prefer prime/trophy office properties.

Investors continue to expect pricing discounts across all sectors. The largest discounts are expected for value-add office assets, followed by stabilized office assets and shopping malls. Just under half of investors expect less than 10% pricing discounts for multifamily and industrial & logistics assets. The smallest discounts are expected for grocery-anchored retail centers.

The Bottom Line

While fears of a recession have eased significantly from last year, expectations of higher-for-longer interest rates and tight credit conditions continue to weigh on investor sentiment. This will keep commercial real estate investment activity subdued in H1 2024. Nevertheless, a majority of investors plan to buy and sell as much or more assets in 2024 than in 2023. They also expect investment activity to pick up in the second half of the year. CBRE concurs with this view as interest rates fall and financial conditions stabilize.