EXPERTISE

Every project we take on is carefully evaluated for minimal risk, maximized design efficiency, construction cost controls, and the financial strength to provide top-tier preferred investment returns. Our target investment size ranges from $20M to $100M in total capitalization, with a focus on both transitional and generational assets that fit both short-term and long-term investment strategies.

Land Entitlement

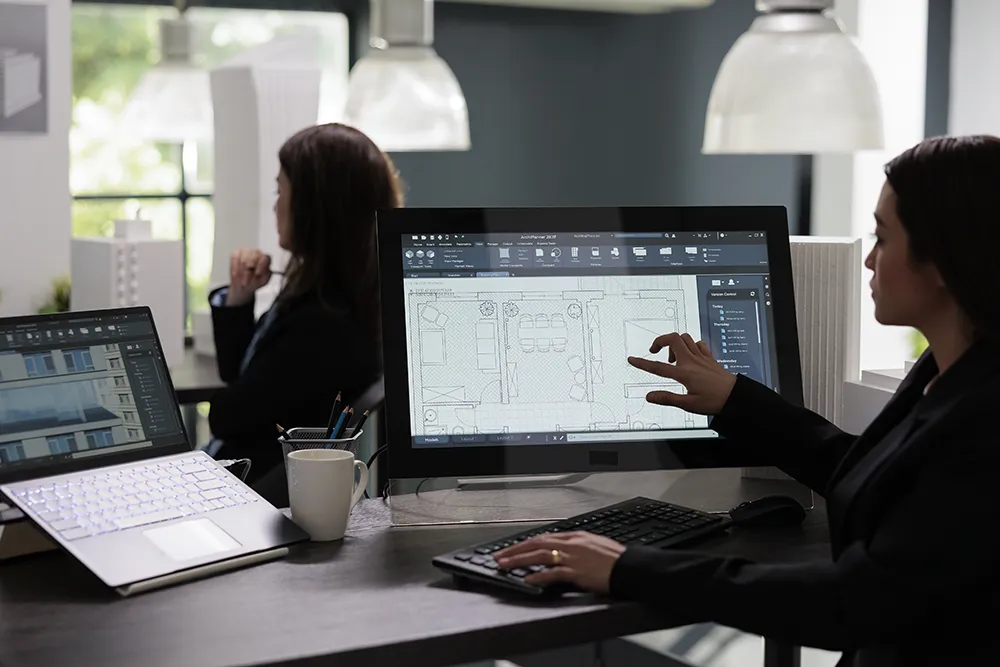

Land entitlement is the process of gaining approvals from a city to develop raw land. The entitlement is then a legal agreement between a government and a landowner that will allow the proposed development. The process involves architectural and engineering plans, soils tests, environmental analyses, and more. Our expert team has entitlement experience from both the developer’s and city’s perspective and has successfully processed entitlements in many jurisdictions throughout California.

Full-Service Construction

With an in-house construction company, we ensure that any construction project we take on is completed on-time and on-budget. Our construction experience spans multiple product types, including residential, commercial, industrial, and infrastructure.

Commercial Redevelopment

As cities evolve, once bustling shopping centers or industrial buildings sometimes outlive their useful lives, presenting the opportunity for redevelopment into a higher and better use. A common example might be demolishing an old strip mall and replacing it with mixed-use housing. Commercial redevelopment adds another layer of complexity to the entitlement process that can often include zoning changes and political and community outreach, but with large upside potential.

Build-For-Rent Communities

A “Build-For-Rent” community is a neighborhood of for-rent single family homes. These communities offer the benefits to renters that don’t come with traditional apartment living such as private backyards, more space, flexible floor plans, luxury features, and easy parking. Build-For-Rent residences also enjoy the freedom and flexibility of a lease compared to the long-term financial commitment of home ownership.

Value-Add Multifamily

Property Management

Any product we build and hold as an asset is also managed by us through our in-house, full-service property management company.

The Renaissance Investment Approach

Identify the right opportunity with a clear path to success

Conduct thorough due diligence to minimize risk

Create value by strategically reposition the asset to its highest and best use

Sell the asset to capture the value created, or manage the asset for the long term gains